Enbridge Pipeline on the Map

wwing/iStock via Getty Images

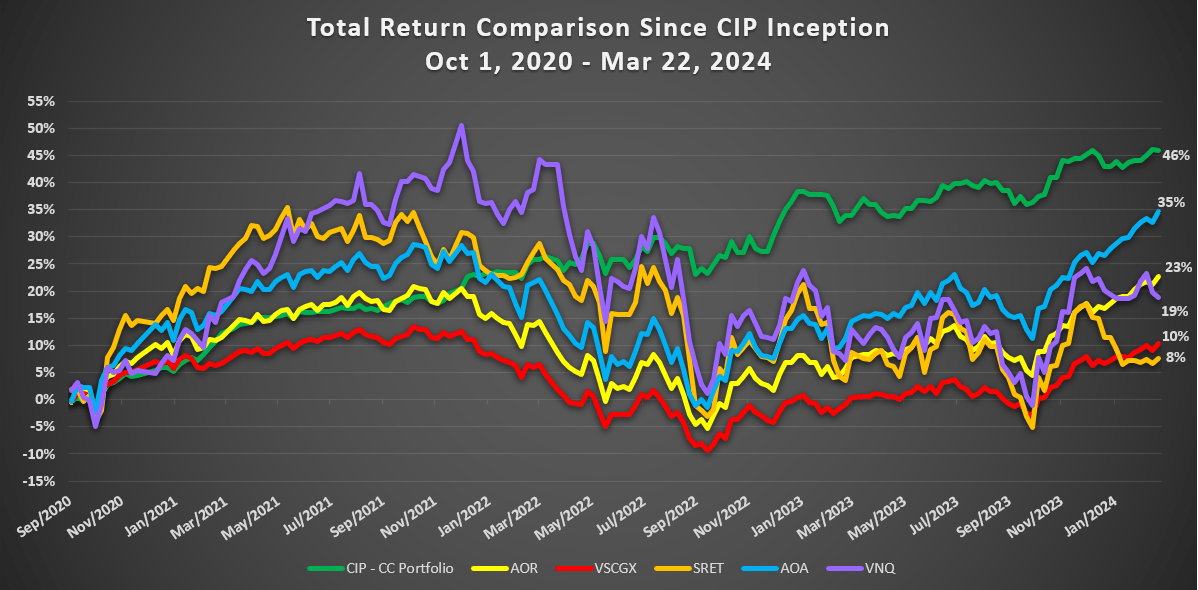

We upgraded Enbridge Inc. (NYSE:NYSE:ENB, TSX:TSX:ENB:CA) from a buy to a strong buy when we wrote on it earlier this year. This upgrade was based on our review of the Q4 numbers. Fantastic execution of a recent purchase, a good standing with the credit agencies and a blowout guidance for 2024 played into our reasoning for the upgrade. The selling after the initial euphoria made sense in this bubble stock era, and it only helped in making ENB a better value buy.

The market seemed happy on the results, but then the selling kicked in. This likely has little to do with the results and more to do with the FOMO bug that is taking over the rest of the market. If you can make 300% annualized chasing bubble stocks, who the heck wants to make 10% a year? Of course that pool of fools is not infinite, but it does distract from value buying. ENB though was a good buy before the results and the small price decline alongside the great results, just elevated the value for us. We are now moving this to a Strong Buy and think the upside is material over the next two years.

Source: Blowout Guidance Underscores The Bull Case

We even suggested a preferred issue of the company for those that were a bit queasy with the volatility of the commons. And volatility was certainly present.

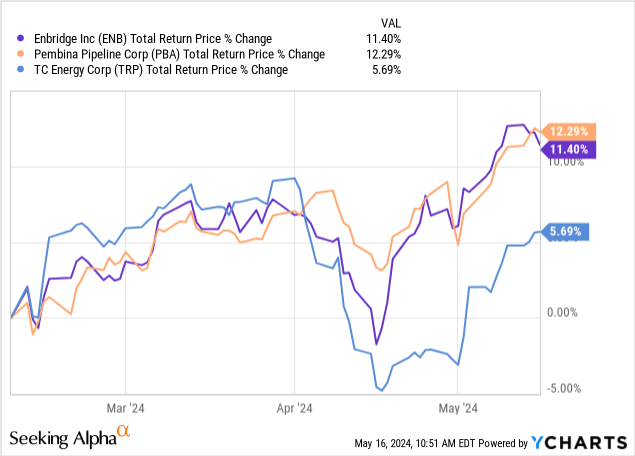

ENB still delivered a healthy 11.40% when all was said and done since then. It also beat TC Energy Corp (TRP) unlike the last time around, and came only marginally lower than Pembina Pipeline Corp (PBA) in terms of the total return on price.

The Q1 results were released last week and we will review those today.

Q1-2024

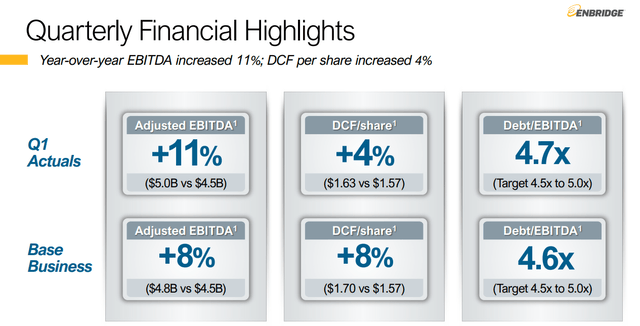

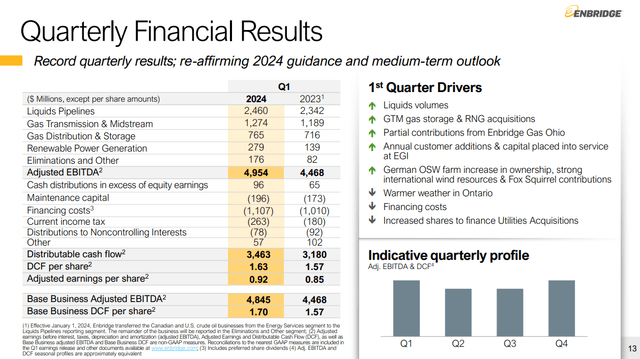

ENB produced record results in Q1-2024, with adjusted EBITDA of $5.0 billion that beat consensus estimates by about 8%.

Q1-2024 Presentation

This is a big beat for a company of this size and one which has 30 analysts following it. About 25% of the beat ($100 million) was via the sale of tax credits, which was not built into any of the models. The results were extremely impressive, nonetheless, as all segments fired simultaneously. The impact was even more magnified in the case of the distributable cash flow, or DCF, metric. Thanks to an expansion in the share count, DCF was widely expected to contract year over year to $1.51 per share. Instead, we got $1.63.

Q1-2024 Presentation

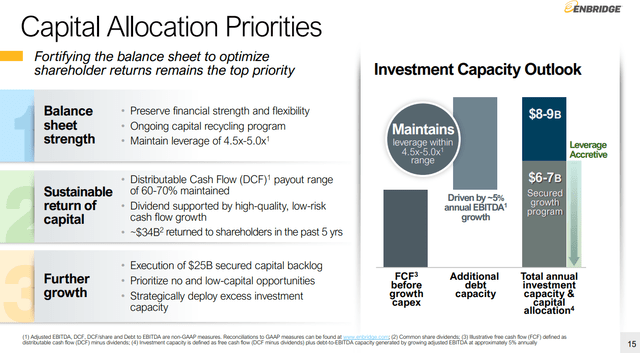

Enbridge stuck with its earlier 2024 guidance of $16.9 billion in adjusted EBITDA (midpoint) and $5.60 in DCF (midpoint) share. This follows the trend of other pipeline companies like TC Energy (TRP), which also did not raise guidance despite a big beat. Leverage remains in the right range, and the watchful eyes of the credit rating agencies are no doubt less trigger happy for a downgrade today than when ENB announced the large acquisition of Dominion (D) assets.

Outlook & Valuation

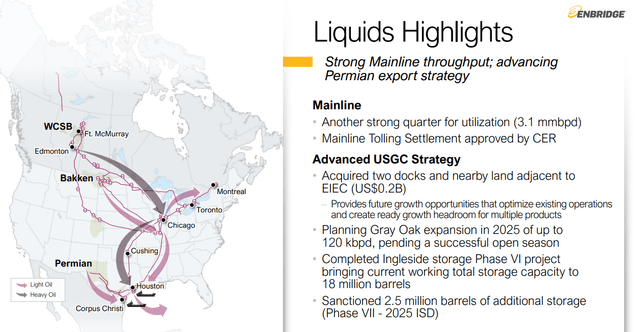

ENB's Mainline settlement has taken a lot of the heat off the company. As Transmountain pipeline enters service in Q2-2024, ENB should see minimal impact with contract locked till 2028.

Q1-2024 Presentation

What the Transmountain Pipeline will do is that it will act as a huge credit positive event for all its customers. The haunting memories of 2018 are likely just a shadow today, but it is something every energy company in Canada wishes to avoid. The investment case for ENB remains compellingly clear as long as management does not do anything silly. Well, perhaps the correct term "does not do anything else that is silly." The Dominion asset purchase was definitely one that threw an unnecessary wrench in the works, and the balance sheet repair will cost investors.

Q1-2024 Presentation

That said, the dividend remains safe and the current results affirm that our longer term price target of $40 USD remains intact. We base that on a 9X AFFO multiple applied to our expected 2025 DCF. At present, that still presents a rather compelling upside when coupled with that 7.25% yield. This is even more true in the maniacal markets of today, where the risks are skewed to the downside. On a relative basis as well, we see ENB offering the highest value compared to TRP, PBA and Keyera Corp (KEY:CA). We are maintaining our Strong Buy rating at this time.

Preferred Shares

ENB has a legion of preferred shares that trade on the TSX. For the US investor, there are a few that may be of particular interest. We are referring to the ones that trade on TSX, but in US Dollars. With exchange risk out of the way, it is easy to see the relative merits of these preferred shares.

1) Enbridge Inc. CUM RED PF S L (TSX:ENB.PF.U:CA)

The prospectus of the Series L shares can be found here. The shares currently yield just 7.06%, so they are on the lower side relative to their 2 year history. But the important aspect is the reset. These will reset in September 2027 at five-year United States Government treasury bond yield plus 3.15%. At the current 5-year treasury rate of 4.45%, the reset would be at 7.60% on par. That may not sound that great, either, until you take into account that these are trading at $20.75 USD. The 7.6% yield on par works out to 9.15% at the current price. Of course, the 5 Year Treasury yield could be higher or lower by then. But investors can draw comfort from the fact that the 5-year treasury would have to drop below 2.70790% on reset for you to get a lower yield from September 2027, than you do now.

2) Enbridge Inc. CUM PREF SHS SR1 (TSX:ENB.PR.V:CA)

The prospectus for this one can be found here. This one was reset very recently in the middle of 2023. It yields 7.65% on the current price ($21.90 USD) and that is fixed till June 2028. This one resets too based on the 5 Year Treasury yield and the spread is almost identical at 3.14%. One thing to note here is that though you are getting a higher yield, you are also paying more than a $1 extra for these shares vs the ENB.PF.U. While they do not reset at exactly the same time, there should be some convergence of the price between these two over time. Still, for someone looking for a fixed yield for about 4 years, you cannot go wrong with this one. Both these preferred shares will appeal most to those who believe that interest rates have set a long term bottom and will move upwards over time. If you are expecting a ZIRP (zero interest rate policy) comeback, these are to be avoided.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.